Subprime personal loan lenders

The principal loan amount. And hard inquiries make up 10 of your score and can cause it to drop.

7 Bad Credit Loans With Guaranteed Approval 2022 Badcredit Org

And lenders for bad credit may offer both options but that will depend on the specific lender.

. We examined closed LendingTree auto loans from H1 2022. Brokerages and investment companies with responsibilities in counseling clients marketing. Our experts reviewed the best personal loans for bad credit ranking them below based on approval rates reputation loan amount and terms.

15000 Minnesota nurses to strike as they demand better conditions Nurses plan to stop working Sept. The requirements for FHA mortgage insurance include. A personal loan with a co-signer has some similarities and differences with a joint personal bad credit loan a personal loan with a co-borrower.

The debt may be owed by sovereign state or country local government company or an individualCommercial debt is generally subject to. Debt is an obligation that requires one party the debtor to pay money or other agreed-upon value to another party the creditorDebt is a deferred payment or series of payments which differentiates it from an immediate purchase. A credit rating agency CRA also called a ratings service is a company that assigns credit ratings which rate a debtors ability to pay back debt by making timely principal and interest payments and the likelihood of defaultAn agency may rate the creditworthiness of issuers of debt obligations of debt instruments and in some cases of the servicers of the underlying debt but.

A down payment of 10 for credit scores between 500 and 579. As a result of the borrowers lower credit. While interest rates are not the only costs associated with taking.

And hard inquiries make up 10 of your score and can cause it to drop. If there is a guarantor provide the persons full name. Thats true even for denied credit.

Name of Agreement or Note. 12 in what is believed to be the largest private-sector nurses strike in US. Loan scammers even use fake company logos false caller ID numbers and other tricks to impersonate legitimate agencies and gain trust.

While most banks and lenders decline bad credit loan applications these companies specialize in getting people with poor credit scores approved. A subprime mortgage is a type of mortgage that is normally issued by a lending institution to borrowers with low credit ratings. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders.

The scammer often hooks their target by making a big promise they cant deliver on or by hiding the actual cost of the loan. In the US the Federal government created several programs or government sponsored. We also looked at the advertised starting car loan rates of large national lenders to compare.

The FHA encourages loan officers to approve subprime borrowers by insuring loans. The average auto loan rate for a new car was 407 in the first quarter of 2022 while the typical used-car loan carried an interest rate of 862 according to Experians State of the Automotive. A subprime loan is a loan offered to individuals who are unable to qualify for conventional loans.

Specify the total. A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as collateral. 1 which lenders consumers chose most often and 2 which ones offered the lowest average APR.

The subprime option is available in many types of loans including auto loans and personal loans. Company Company - Logo Minimum credit score Current APR range Loan amounts Learn More CTA text Learn more CTA below text LEARN MORE. Below is a list of the top subprime mortgage lenders in no particular order.

Every time you apply for a new credit card or loan it can show up as a hard inquiry on your credit report. State any guarantor on the loan agreement or note. A loan scam is a loan thats offered under false pretenses.

They were forced to close their subprime lenders and despite their many attempts to stop the bleeding such as issuing stock they continued to take on losses until on Sept. In finance subprime lending also referred to as near-prime subpar non-prime and second-chance lending is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically subprime borrowers were defined as having FICO scores below 600 although this threshold has varied over time.

Carrington offers many of the standard loan programs such as FHA Conventional VA and USDA. List of Subprime Mortgage Lenders. A down payment of 35 for credit scores of 580 or higher.

Your credit report gives a full background of your credit history including personal information delinquent accounts and. But both types of personal loans can be used by people with a bad credit score. Provide the full name or title of the agreement or note that details the loan between the borrower and lender.

799 to 2343 with autopay. Every time you apply for a new credit card or loan it can show up as a hard inquiry on your credit report. Also provide the date of the loan agreement or note.

15 2008 Lehman. We wanted to know. Finance graduates career opportunities are quite diverse but include positions with business corporations and nonprofit organizations with responsibilities in financial management administration of funds protection of assets tax administration and investor relations.

Your monthly interest rate Lenders provide you an annual rate so youll need to divide that figure by 12 the number of months in a year to get the monthly rate. Thats true even for denied credit. Between them all we can help you with your loan no matter what it is and in any state.

Subprime loans provide opportunities for low quality borrowers to buy homes and other goods. However if these borrowers default owing to higher. Your credit report gives a full background of your credit history including personal information delinquent accounts and.

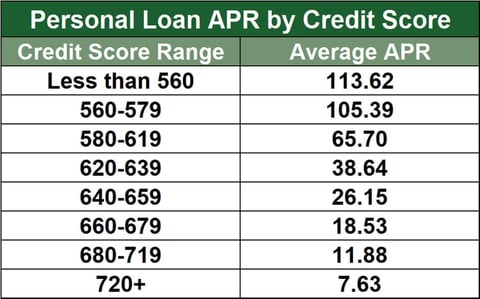

A mortgage loan is a very common type of loan used by many individuals to purchase residential or commercial property. Personal loan rates currently range from around 4 to 36 depending on the lender borrower creditworthiness and other factors. The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full.

A collateralized debt obligation CDO is a structured financial product that pools together cash flow-generating assets and repackages this asset pool into. The Federal Housing Administration backs loans from conventional mortgage lenders. Collateralized Debt Obligation - CDO.

How To Get Personal Loans For Credit Scores Under 550

Get 60 Month Car Loans Guaranteed Approval At Affordable Rates From Carloansbadcredithistory Com Apply Online For Instant App Car Loans Car Finance Loan Rates

Best Personal Loans Of 2022 Top 10 Online Loan Companies For Low Rates

7 Bad Credit Loans With Guaranteed Approval 2022 Badcredit Org

Pin On Financial Services

Best Bad Credit Loans Of 2022 Forbes Advisor

Marriage Is An Important Milestone In Everyone S Life Many People Especially Girls Dream Of Having A Fairy T Payday Loans Online Payday Loans Personal Loans

Best Personal Loans Of 2022 Top 10 Online Loan Companies For Low Rates

Bad Credit Loans 5 Best Lenders For People With Poor Credit

Best Personal Loans Of 2022 Top 10 Online Loan Companies For Low Rates

Pin On Personal Finance Tips

4 Best Personal Loans For Fair Credit September 2022 Wallethub

Best Personal Loans Of September 2022 Forbes Advisor

Best Personal Loans Of September 2022 Forbes Advisor

Transunion Forecasts Originations To Non Prime Borrowers Will Continue To Rise For Many Credit Products In 2022

5 Best Loans For Bad Credit Of 2022 Money

Asset Backed Securities Abs An Umbrella Term Used To Refer To A Kind Of Security Which Derives Its Value From A Pool Of Asse Asset Personal Loans Car Loans